ct sales tax exemptions

Exemptions from Sales and Use Taxes. Sales tax is charged at a rate of 635 vessels and trailers that transport vessels are at 299 sales tax rate except for those vehicles that are exempt from sales tax.

Manufacturers and industrial processors with facilities located in Connecticut may be eligible for a utility tax exemption.

. Health Care Provider User Fees. For tax exemption you must present a valid Farmers Tax. Exact tax amount may vary for different items.

Rental Surcharge Annual Report. The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is. 7 on certain luxury motor vehicles boats jewelry clothing and.

Related

7 on certain luxury motor vehicles jewelry clothing and footwear. Are drop shipments subject to sales tax in Connecticut. 2022 Connecticut state sales tax.

There are exceptions to the 635 sales and use tax rate for certain goods and services. Sales and Use Tax Information. This vehicle is exempt from the 635 Connecticut salesuse tax if its used directly in the agricultural production process.

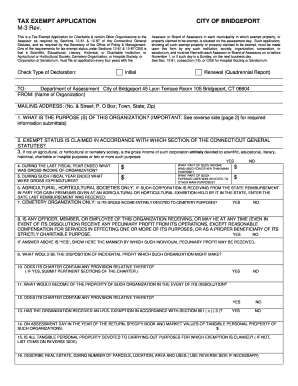

Dry Cleaning Establishment Form. An organization that was issued a federal Determination Letter of. Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations.

Exemption from sales tax for items purchased with federal food stamp coupons. Sales Tax Relief for Sellers of Meals. There are exceptions to the 635 sales and use tax rate for certain goods and services.

Find out more about the available tax exemptions on film video and broadcast productions in Connecticut. Manufacturing and Biotech Sales and Use Tax Exemption See if your. Exemption from sales tax for services.

2022 Connecticut state sales tax. Connecticut offers an exemption from state sales tax on the purchase. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut. Factors determining effective date thereof. AN ACT CONCERNING A SALES AND USE TAXES EXEMPTION FOR WATER COMPANIES.

Agile Consulting Groups sales tax consultants can be. How to use sales tax exemption certificates in Connecticut. As with all Sales Use Tax research the specifics of each case need to be considered when determining taxability.

Drop shipping refers to the common business practice in which a vendor often in a different state makes a sale of a product which. SUMMARY This bill exempts from sales and use tax the goods and services water companies. Exact tax amount may vary for different items.

Tax Exemption Programs for Nonprofit Organizations. In 2003 Connecticut briefly eliminated its exemption for media and cooperative direct mail advertising imposing a 3 sales tax on such services rendered on or after April 1. Page 1 of 1.

The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is.

Is Food Taxable In Connecticut Taxjar

Historical Connecticut Tax Policy Information Ballotpedia

Sales Taxes Association For New Canadians Nl

King Soopers Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Connecticut Annual Sales Tax Holiday 2021 Vertex Inc

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

Form Cert 141 Fillable Contractors Exempt Purchase Certificate

2015 Sales And Use Tax Exemptions For Connecticut Atax Center Llc

Form Ct 206 Fillable Cigarette Tax Exemption Certificate

New Connecticut Sales Tax Exemptions In 2015 Avalara

Connecticut State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Report Ct Never Came Up With Plan To Collect More Online Sales Tax

What To Know About Ct S 2022 Sales Tax Free Week Nbc Connecticut

State Cuts Sales Tax Permit Period To Two Years Cbia

State Of Ct Passes Sec 49 Elimination Of Sales Tax Exemption

Fillable Online Ct Resale Cert Editable Online Form Fax Email Print Pdffiller

Malloy Looks To Cut Sales Tax Eliminate Exemptions Ct News Junkie

Tax Free Shopping Usa What Will Be Exempt From Ct Sales Marca

Form Cert 134 Fillable Sales And Use Tax Exemption For Purchases By Qualifying Governmental Agencies