pay ohio business taxes online

Businesses with over 4 million in gross receipts must pay both a base tax of 2600 plus 026 percent of gross receipts To pay the CAT you must comply with specific. Create MyAccount eFile Withholdings Make Payments Check Refund Status Update Account Profile View Payment.

Businesses Department Of Taxation

Employers can also use this application to E.

. If you drop off documents in. If you have a Gateway account you have an OHID. Free to File Easy to Use Faster Refund Log in to secure zone.

It provides tools that make it easier for any business owner to file and pay sales tax commercial activity tax employer withholding unemployment compensation contributions workers. There is a processing fee to use this. The Ohio Business Gateway is experiencing issues with all Taxation redirect transactions.

E-File provides an easy-to-use system that allows businesses to make withholding and estimated tax payments through ACH Debit. Ohio Business Gateway Save time and money by filing taxes and other transactions with the State of Ohio online. Springfield Income Tax Division.

Ohio Business Taxes April 23 2020 Agency. Ohio Department of Taxation. They accept electronic checks Visa MasterCard and Discover Card.

Scan bills schedule payments and pay with your credit card to extend float. There is a 400 transaction fee for Internet Checks or a 25 fee for. Ad Honest Fast Help - A BBB Rated.

Business - Online Services See what MyAccount has to offer. Up to 25 cash back The commercial activity tax considered a tax on the privilege of doing business in Ohio is computed based on your businesss gross receipts as. Paymentus processes online payments for the Newark Tax Office.

If your business closes you must deactivate your account online at thesourcejfsohiogov or by completing a JFS 20110 Disposition of Business and mailing it to PO. Please make a payment here or contact us at 888-301-8885. Ad Submit Your Access Ohio Payment Online with doxo.

Ohio businesses can use the Ohio Business. It is our aim to make payment as convenient as possible. Start wNo Money Down 100 Back Guarantee.

Use your existing username and. Ohio Department of Taxation Individual Income Tax Online Services - Login. Ohio Business Gateway Save time and money by filing taxes and other transactions with the State of Ohio online.

CRISP allows individuals and businesses to make the following payments via credit card debit card or electronic check. New Look Same Login. Available 247 the departments online services can help you electronically file an Ohio IT 1040 SD 100 andor IT 10 while providing detailed instructions and performing.

For your convenience a document drop box is available for use as well. Payment of Assessments Declaration of Estimated Tax for. Ad Find out what tax credits you qualify for and other tax savings opportunities.

Learn about specific taxes and payments that may be required of businesses with Hamilton County and how to make those payments. Get a personalized recommendation tailored to your state and industry. Get a personalized recommendation tailored to your state and industry.

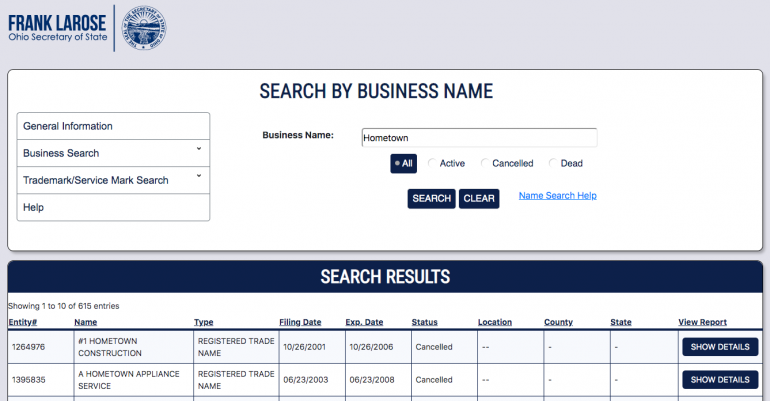

Please call 8777673453 877-SOS-OHIO to see if a walk up appointment is available. Also provided is a link to. Ad Find out what tax credits you qualify for and other tax savings opportunities.

Learn about obg current alert Learn More Web Content Viewer. Ohio Business Gateway Save time and money by filing taxes and other transactions with the State of Ohio online. Ohio businesses can use the Ohio Business.

Free Unbiased Reviews Top Picks. Ohio Business Gateway - Use the Ohio Business Gateway to register file and pay many types of. Ad Pay your business bills quickly and easily online.

Payment can be made by credit or debit card Discover Visa MasterCard or American Express using the departments Online Services Guest Payment Service directly visiting ACI. Ohio Business Gateway Web Content Viewer. If you were not fully withheld by your employer for tax.

CITY HALL FIRST FLOOR is now open with normal hours Monday Friday 800 am 500 pm. Online Services for Business. FEDERAL IRS PAYMENTS Personal Taxes Business Taxes Make A Payment.

Investing in Ohios Future Find out more about available support for. Ad Compare This Years Top 5 Free Payroll Software. This page offers resources for filing and paying business taxes online.

Take advantage of our fast convenient payment options and pay your bills on time on your time every time. A 25 fee applies to. Authority TaxConnect is available to individual taxpayers and will allow them to create a secure login review their tax balances for each year and make payments.

Simplify your accounts payable.

![]()

Llc Ohio How To Start An Llc In Ohio Truic

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Forming An Llc In Ohio A Step By Step Guide Nerdwallet

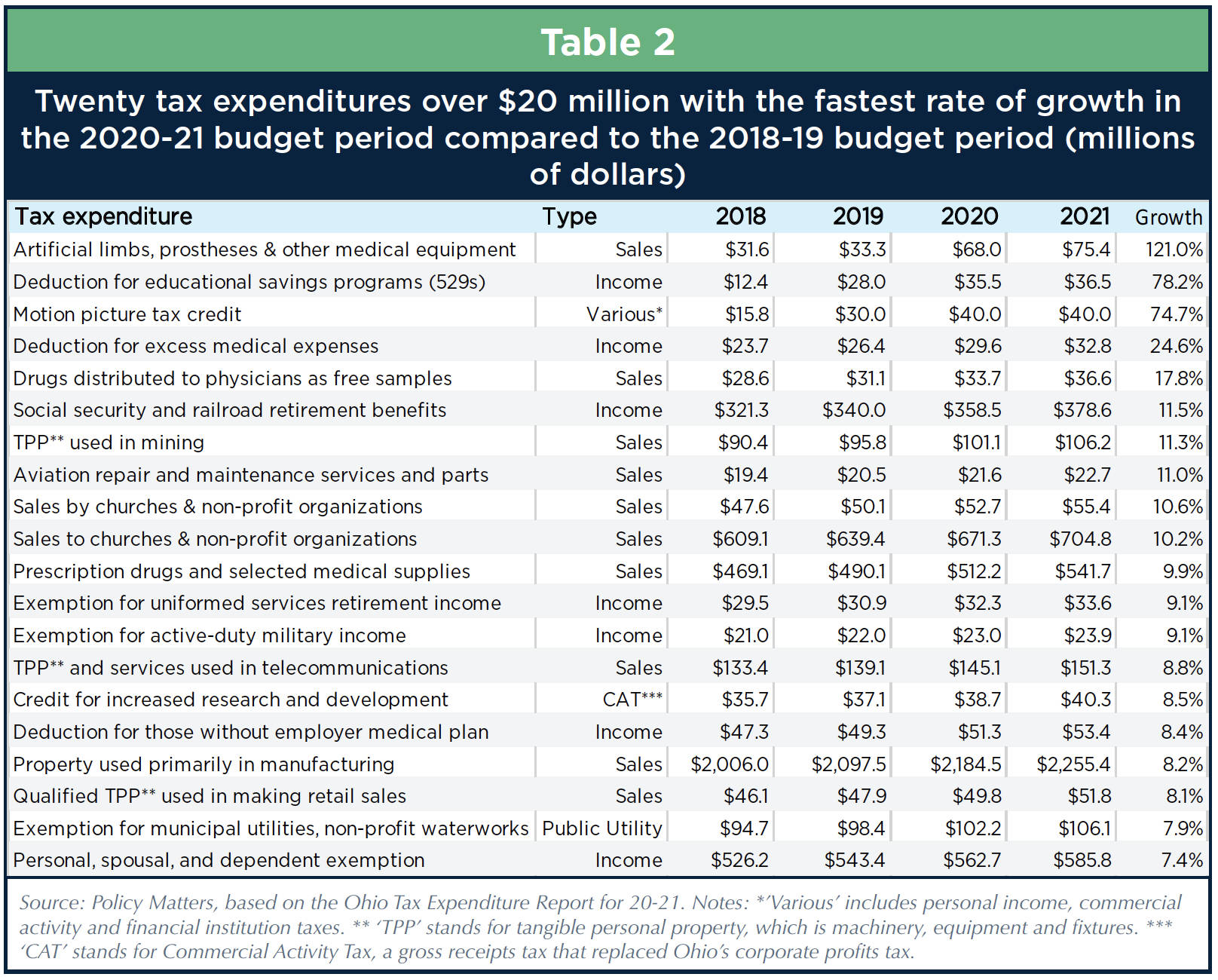

General Sales Taxes And Gross Receipts Taxes Urban Institute

How To Start A Business In Ohio With No Money Nerdfounder

Sales And Use Tax Electronic Filing Department Of Taxation

Business Tax Electronic Payments Department Of Taxation

Ohio Business Gateway Ohio Gov Official Website Of The State Of Ohio

Online Services Business Taxes Department Of Taxation

Use Tax What Is It And What Are Your Business Owner Responsibilities

Business Tax Electronic Payments Department Of Taxation

Ohio Department Of Taxation Facebook

Home Regional Income Tax Agency

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Income Tax City Of Gahanna Ohio

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You